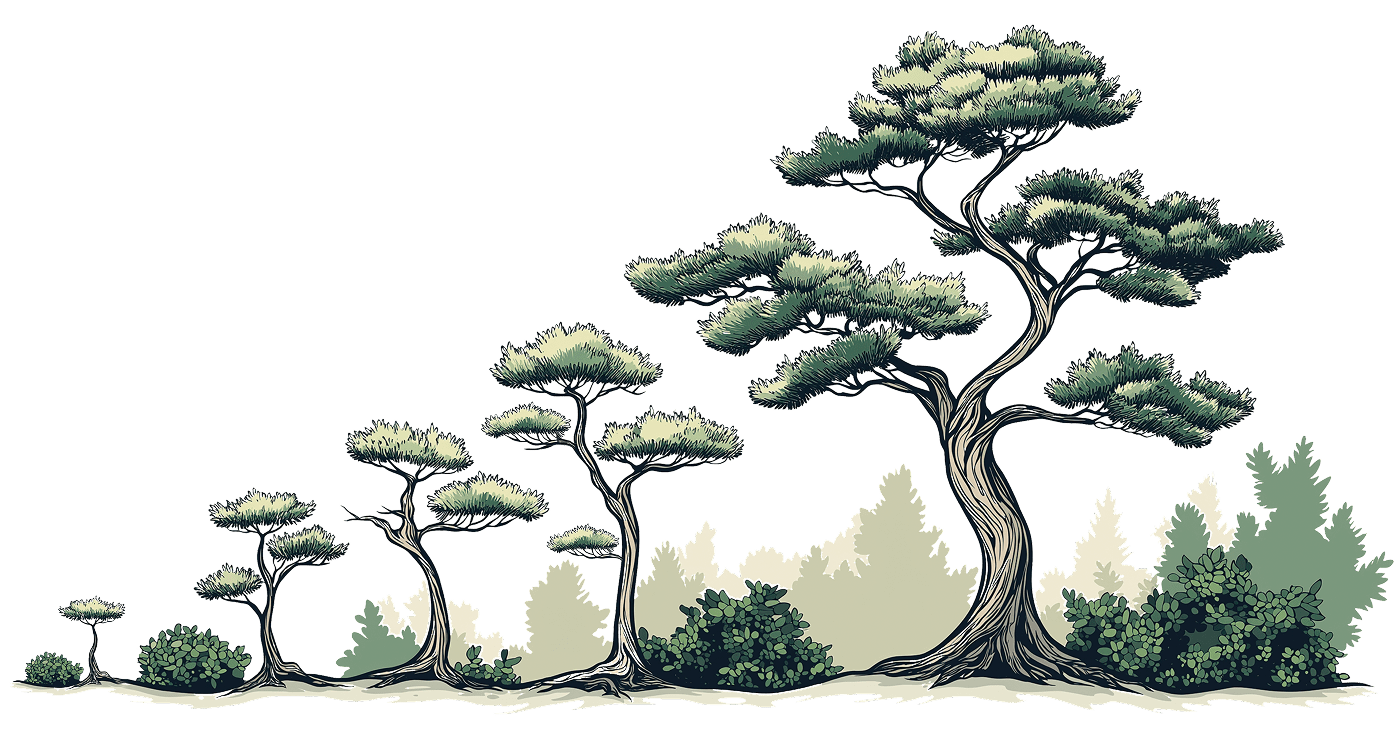

We continued to closely monitor developments in the market, proactively responding

with strategic interventions to ensure resilience, and sustainable growth. Our

strategic response to industry dynamics and the resultant performance can be viewed

below.

Read about

our Operating Environment

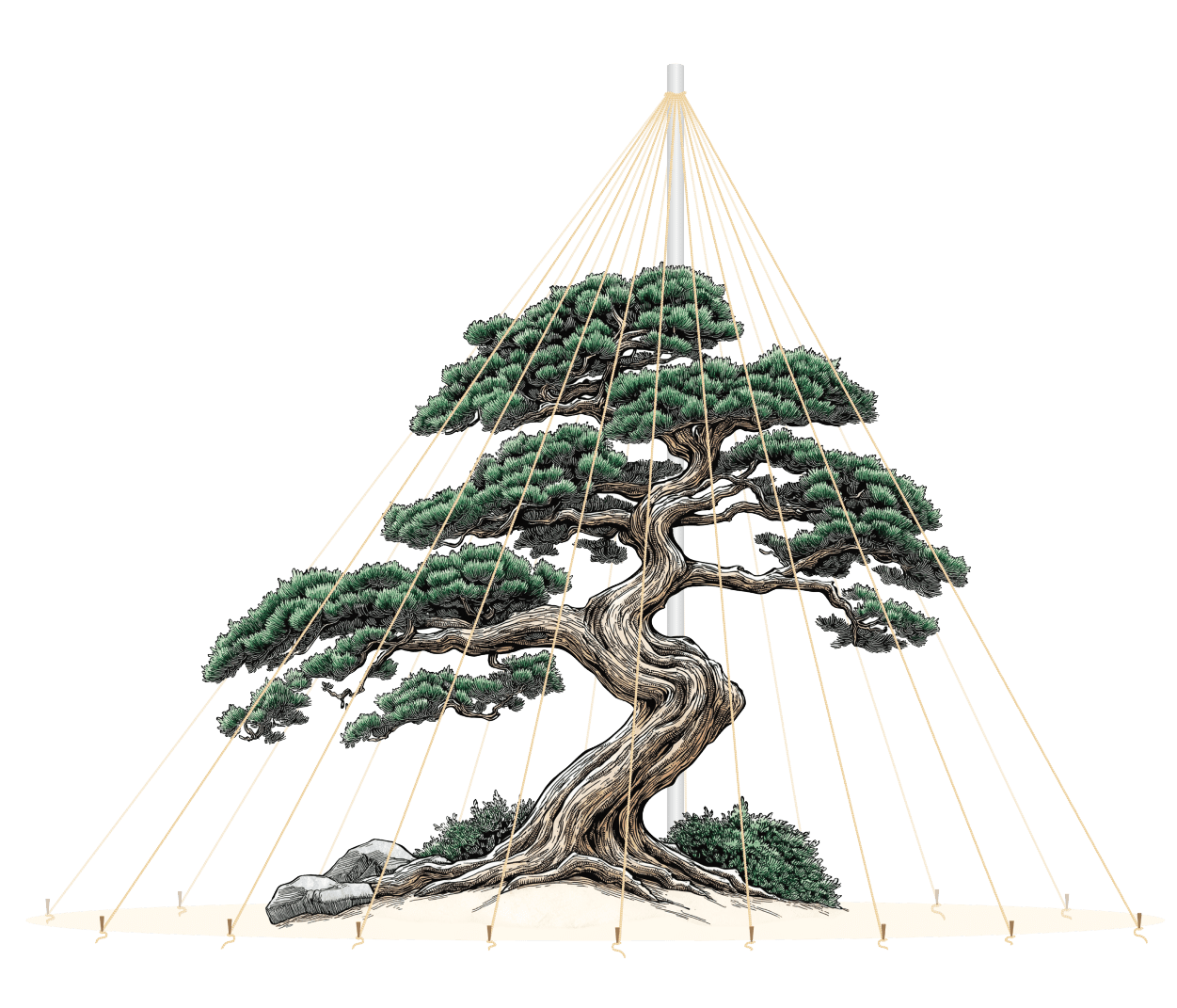

In presenting our Strategy in this Annual Report with greater clarity, we have

condensed our strategic focus to three key strategic pillars - Business Focus,

Operational Excellence and Empowered Stakeholders.

Whilst each strategic pillar will have its own short to long term focus, the purpose

of this depiction is to demonstrate how all of the Group’s efforts are ultimately

directed towards empowering our stakeholders and supporting them in unlocking

prosperity.

Discover

our Blueprint for Smart Growth